12 American Retirement Savings Statistics & Facts: 2025 Update

-

- Last updated:

Note: This article’s statistics come from third-party sources and do not represent the opinions of this website.

We all get old one day, and the best way to build a financially stable future is to have as much retirement money as possible. This way, you won’t have to solely rely on the government pension (which can be quite small) to support you after retirement. And to help you become better educated on the matter, we made a list of the biggest retirement savings statistics and facts—12 in total.

Remember: it’s never too late to open a retirement fund, and the more you know, the easier it will be to maximize your savings! Now let’s get right to it!

Click below to jump ahead:

The 12 Statistics and Facts About American Retirement Savings

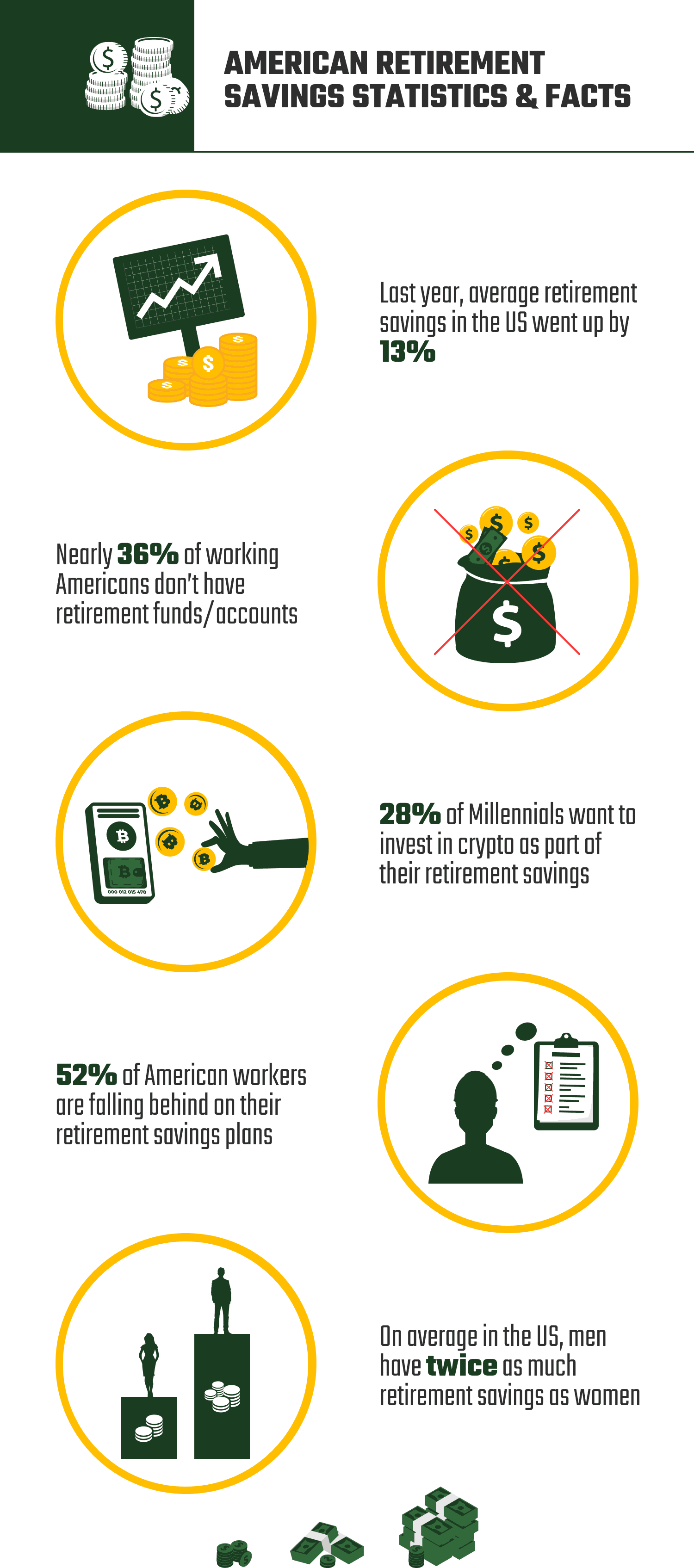

- In 2021, the average personal and retirement savings in the US went up 10% and 13%

- 52% of American workers are falling behind on their retirement savings plans

- Nearly 36% of working Americans don’t have retirement funds/accounts

- By 2030, there will be over 73 million retirees in the US

- The Russia-Ukraine War has 42% of US citizens delaying their investments

- Baby Boomers have 102K in retirement savings (more than any other age group)

- Millennials trust Roth IRAs with 74% of their savings

- 28% of Millennials want to invest in crypto as part of retirement savings

- Gen Z is more willing to change their financial habits (62%) vs. other age groups (47%)

- 30% of Gen Z workers look for financial guidance

- Men have twice as much retirement savings than women ($118K vs. $57K)

- Life expectancy for women is higher compared to men (81 vs. 77)

General Statistics

1. In 2021, the average personal and retirement savings in the US went up 10% and 13%

(Northwestern Mutual)

The negative impact of the pandemic on the economy is very big. Since early 2020, the financial sector in the US has been taking a heavy hit. However, in 2021, the personal and retirement savings of regular American citizens saw a decent boost (10% and 13%, respectively). Personal savings went from $66K to $73K, while the average retirement fund jumped from $87.5K to $99K.

On top of that, only 9% of the people with retirement savings had to spend some of those savings to get by. In contrast, 33% were able to put more money into the funds, while 31% stated that they decided to stop saving for a while to make it through the tough times. Lastly, a third of US citizens managed to become more financially conscious and disciplined.

2. 52% of American workers are falling behind on their retirement savings plans

(Bankrate)

With workers forced to make early money withdrawals to cope with the pandemic, more than half of them (52%, to be exact) admitted that COVID-19 has set them back 1–2 years on their financial stability and security goals. Only 11% of the respondents said they were a step ahead of the initial plan. Loss of income was reported by 49%; additional expenses came in at 32%, while additional debt was stated by 21%.

3. Nearly 36% of working Americans don’t have retirement funds/accounts

(Bankrate)

That same survey revealed that more than a third of workers in the United States have never even had a retirement plan/account, to begin with (meaning IRA or 401(k)). Approximately half of the low-income households confirmed that they’ve never had a retirement account set up. The same is true for Generation Z: 54% of Gen Z workers haven’t had the privilege of creating a retirement account.

Furthermore, 60% of US natives don’t have enough money saved up to cover an unforeseen expense of $1K.

4. By 2030, there will be over 73 million retirees in the US

(Bloomberg, Census.Gov)

In the upcoming years (or, rather, decades), we’ll witness exponential growth of pensioners in America. With people from the Baby Boom era getting older, by 2030, the country will have more than 73 million retirees on its hands, and that’s 22% of the total population of the US (329 million registered citizens in 2020).

5. The Russia-Ukraine War has 42% of US citizens delaying their investments

(MassMutual)

The ongoing war in Ukraine is making almost half of Americans (42%) stop investing, with 73% believing the conflict will hurt the US economy. More than that, 45% of the respondents claim the Russian invasion is forcing them to rethink their lifestyle and spending habits.

Different Age Groups Statistics

6. Baby Boomers have 102K in retirement savings (more than any other age group)

(Northwestern Mutual)

Born between 1946 and 1964, Baby Boomers make up 76.4 million of the American population. They’ve had their fair share of struggles over the years and know the value of financial stability and freedom. That’s exactly why they have the biggest retirement savings in the country. Gen Z has $35K in personal savings and $37K in retirement money. The Millennials “beat” that with $51.3K and $63.3K.

People from the Generation X era have even more money saved up to weather the storm ($67K and $99K). However, they’re still not a match for the Baby Boomers that have more than $200K of combined savings.

7. Millennials trust Roth IRAs with 74% of their savings

(CNBC)

For Boomers and members of the Gen X age group, early investments (when you’re still in your 20s) were never really a thing. That’s not the case with Millennials, though. While they do have student loans, credit card debts, and average-at-best salaries, they’re still investing 9 years earlier than their parents did. Now, more than 50% IRA (Individual Retirement Account) contributors trust their money with Roth IRAs.

Millennials, in turn, are investing as much as 74% of their hard-earned dollars into Roth IRAs. The reason: these savings accounts don’t tax retirement money in any way. For most young men and women, not being able to access their money for 20–30 years is a very long time. However, Roth IRAs allow withdrawing your funds without any severe penalties.

8. 28% of Millennials want to invest in crypto as part of retirement savings

(Investopedia)

Cryptocurrency is the next big thing—there’s no denying that. So, it shouldn’t come as a surprise that a large number of Millennials (more than a fourth) are considering investing in crypto as part of their retirement savings plan. Digital/virtual currency is in large demand among Gen Z and Gen X investors as well. However, only 25% of the investors know their way around crypto.

9. Gen Z is more willing to change their financial habits (62%) vs. other age groups (47%)

(Schwab)

The youngest generation of workers in the States—Gen Z—is very stressed about their funds (44% vs. the average of 24%). At the same time, Gen Z is more optimistic about fixing their financial status and changing habits (62%) than Gen X, Millennials, and Boomers (47% in total). Also, 32% of employed Gen Z workers will retire later than planned due to the COVID-19 pandemic, with 23% being the average in the US.

10. 30% of Gen Z workers look for financial guidance

(Schwab)

In a pursuit to put more money into their retirement savings accounts, 1/3rd of Gen Z employees need help managing their finances (expenses) and debt. That’s a significant difference compared to the “industry average” of 22%. Another thing that makes Gen Z stand out: they are more open to computer-generated advice than all the other age groups.

Men vs. Women Statistics

1. Men have twice as much retirement savings than women ($118K vs. $57K)

(Annuity, Census.Gov)

On average, women in the States have $57K in their retirement savings accounts. At the same time, men have $118K, which is more than twice as much. Next, while 35% of working men have $250K+ on their savings accounts, the same is only true for 24% of women. Another quick fact: 81% of men put money aside for retirement vs. 68% of women.

2. Life expectancy for women is higher compared to men (81 vs. 77)

(Simply Insurance, The Balance)

For women, the global life expectancy is 75 years old; for men, it’s only 70. In the States, the statistics are higher for both sexes (81 for women, and 77 for men). With that, the average retirement age in America for women is lower than that for men (63 vs. 65).

Frequently Asked Questions About American Retirement Savings

How much money is enough to retire?

As long as you get 80% of the pre-retirement income during your “eternal vacation”, you’ll be able to live comfortably and sustain the same standard/quality of life that you had when you were still working. But what does that mean in terms of numbers? What’s the minimal amount of retirement savings that will allow you to leave the workforce?

This greatly depends on how much you’re planning on spending a month. For some retirees in the US, $500K is a decent number; for others, this means they’ll have to live paycheck to paycheck. A million dollars is a far better deal. And if you have $1.5 million in the retirement fund, that will guarantee around $80K a year—more than enough for the average retiree.

How can I boost my retirement savings?

The sooner you start, the more money you’ll have waiting for you at the end of the road. This is true even if your monthly savings are rather modest. For example, if you start investing $100 per month at the age of 25, you’ll be able to save more than if you invest $125 but start a decade later (at 35). It might sound a bit strange at first, but that’s exactly how investment accumulation works.

A 401(k) account, along with an IRA will help you save even more in the long run (Merrill).

Median Retirement Savings by Age Groups

Alright, now let’s see how much money people have in their retirement savings based on their age. We begin with the youngest group: 18–24, and on average, they have $4.8K. Moving up the “ladder” (25–29), we’ve got $9.4K—almost twice as much. The same is true for the next age group (30–34, $21.7K), the one right after it (35–39, $48.7K), and the third one (40–44, $101K).

People that are 45–49 years old have approximately 150K US dollars; however, their “big brothers” (50–54) have a bit less ($146K). If you’re 55–59 years old, you’re expected to have the largest retirement savings ($223K), with the 60–64 and 65–59 groups falling slightly behind ($221K and $207K, respectively) (Federal Reserve).

What percentage of my earnings should I save for retirement?

The consensus among experts in the field is that you should put 10–15% of your yearly income into the savings fund (pre-tax, that is). This is a tried-and-true and effective scheme that has proven its worth over the last couple of decades. If you’re a high earner, aim at 14–15%; in contrast, people that earn a bit less than the national average should stick closer to 10%, as social security will compensate for most of that.

With that said, the actual percentage will be determined by three factors: your life expectancy, the age when you’re planning on retiring, and the current state of your personal and retirement savings. Plus, if you want to live in a big way once you step back and retire, you’ll have to put a bit more money into that retirement fund (yes, more than 15%) (NerdWallet).

What’s the average retirement age in the US?

In the States, people plan on retiring at 62.6, which is an improvement over 63.4 in 2020. And if we take the younger generations, they expect to get their well-deserved rest much sooner. Gen Z plan on retiring at 59.4, with Millennials falling slightly behind (59.5). Do keep in mind, though, that if you collect your social security at 62, your pension will be significantly lower compared to claiming it at 67.

The difference is going to be 30%! That’s why many Baby Boomers prefer to wait for a couple of extra years instead of opting for social security way too soon and putting themselves in a financially challenging situation. And if you’re ready to keep working until you turn 67, the social security benefits will be that much higher (Northwestern Mutual, Barrons).

Conclusion

While the US economy is far from crumbling, there’s no better day to start thinking about the future than today. As long as you’ve got retirement savings to back you up, you won’t ever be caught off-guard. We do certainly hope that food shortages and gas prices will go back to normal, but in these uncertain times, savings are your best friends.

America has a long history of relying on “rainy day money” to make it through challenging situations, and financial competence is at the very heart of it. As for the facts and statistics that we covered today, use them to make the right financial decisions and stay one step ahead of the soaring inflation. Take care!

Featured Image Credit: Pixabay

Contents