13 Car Loan Statistics & Facts in Australia: Updated in 2025

-

Pete Ortiz

- Last updated:

Note: This article’s statistics come from third-party sources and do not represent the opinions of this website.

If you live in Australia, you likely need a car regardless of where you live. But unless you have a hoard of cash just lying around, you likely need a loan to get that vehicle. Before you rush out and get a car loan in Australia, it’s a good idea to get some background knowledge first. That way, you know what is normal and what isn’t, and you can make an informed decision about what’s right for you.

We’ve highlighted 13 different car loan statistics and facts for Australia for you here, and we took the time to answer some of the most frequently asked questions you might have!

Click below to jump ahead:

- How Much Australians Spend on Car Loans

- Australian Car Loan Lengths & Interest Rates

- Miscellaneous Australian Car Loan Stats & Facts

Top 13 Car Loan Statistics in Australia

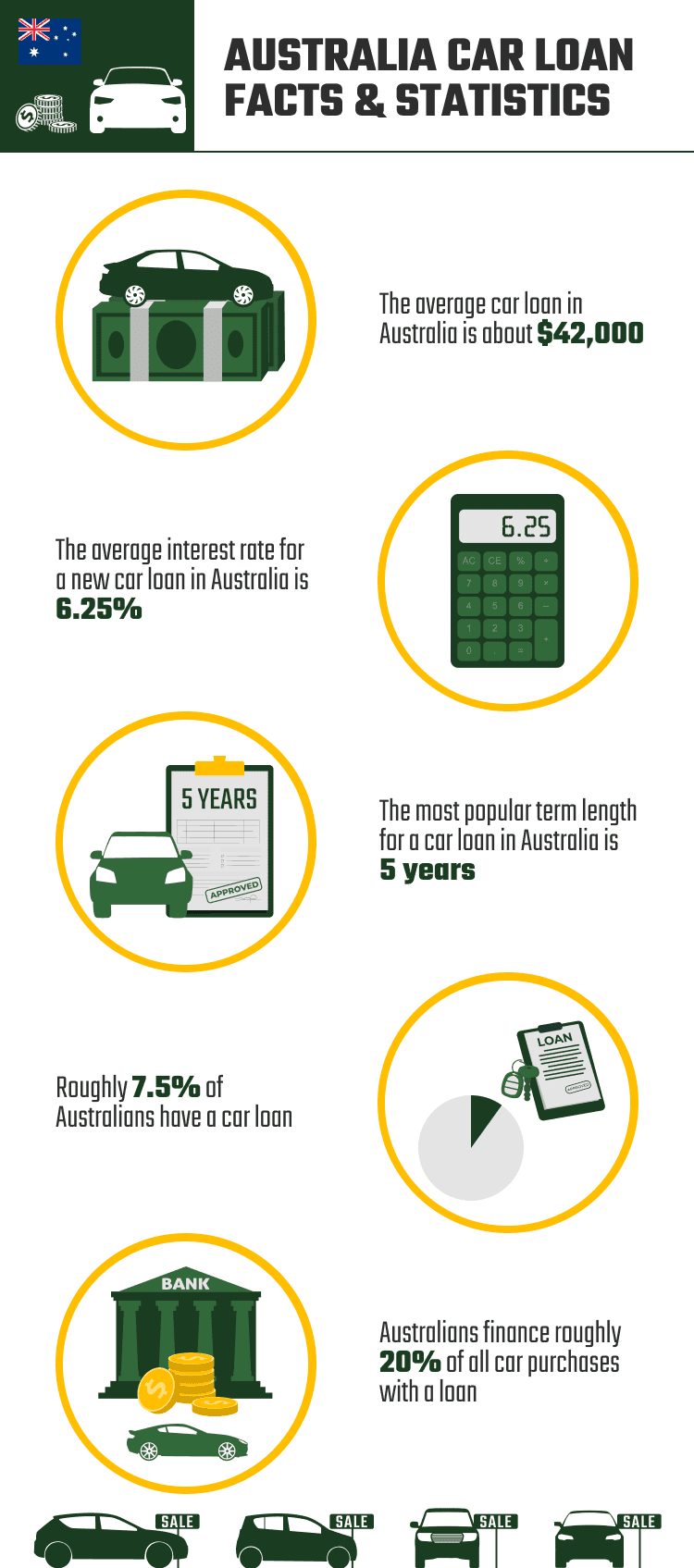

- The average car loan in Australia is about $42,000.

- Australians borrowed $16 billion for car loans in 2017.

- The average car payment in Australia is $591 a month.

- In May 2021 Australians took out $1.296 billion in car loans.

- The average interest rate for a new car loan in Australia is 6.25%.

- The average interest rate for a used car loan in Australia is 6.75%.

- The most popular term length for a car loan in Australia is 5 years.

- The second most popular term length for a car loan in Australia is 7 years.

- Australians finance roughly 20% of all car purchases with a loan.

- Roughly 7.5% of Australians have a car loan.

- 14% to 17% of No Interest Loan Scheme (NILS) loans go to car maintenance.

- Used vehicle prices in Australia have risen 35% in the last year.

- In June 2021 Australians purchased 110,664 new vehicles.

How Much Australians Spend on Car Loans

1. The average car loan in Australia is about $42,000.

(Nodifi)

Did you know that Australia is one of the cheapest places to purchase a new vehicle? But even in Australia, the price of new vehicles is skyrocketing, with the average loan for a new car starting at $42,000.

2. Australians borrowed $16 billion for car loans in 2017.

(The New Daily)

No matter how you look at it, taking out $16 billion in debt over a year is a lot of money. This is especially true since this trend holds every year. In fact, the total number creeps up each year.

3. The average car payment in Australia is $591 a month.

(Nodifi)

When you take out a car loan you have to pay it off, and if you take out a car loan in Australia, the average monthly payment is $591 a month. That’s not as high as it could be, but it’s still a good chunk of change coming out of the monthly budget.

4. In May 2021 Australians took out $1.296 billion in car loans.

(PR Newswire)

Covid-19 took a big hit on the automotive industry, but currently, all signs are pointing to a full recovery. In May of 2021 Australians took out almost $1.3 billion in car loans, and the number likely would have been higher, but there have been issues keeping up with the demand for new vehicles.

Australian Car Loan Lengths & Interest Rates

5. The average interest rate for a new car loan in Australia is 6.25%.

(Mozo)

If you’re looking at getting a loan for a new car in Australia, you want to have an idea of whether you’re getting a good interest rate or not. While your current credit history, monthly income, and more will go into your specific interest rate, 6.25% is the average.

6. The average interest rate for a used car loan in Australia is 6.75%.

(Mozo)

What’s most surprising about this statistic is how close the average interest rate for a used car is to the average interest rate for a new car. While 6.75 is a full half a percentage point higher than 6.25%, it does go to show that there’s not a huge difference in the interest rate.

But keep in mind that used car loans typically have shorter terms, so they can jack up the monthly payment quite a bit.

7. The most popular term length for a car loan in Australia is 5 years.

(Nodifi)

While some countries have embraced longer car loans, Australia doesn’t love that trend. Most car loans in Australia have a term length of 5 years, which certainly helps ensure people don’t end up upside down on their vehicle loans.

8. The second most popular term length for a car loan in Australia is 7 years.

(Nodifi)

While the 5-year loan is still the most popular car loan length in Australia, the second most popular is the 7-year loan. Longer loans lower the monthly payment, but they end up costing more money overall.

Miscellaneous Australian Car Loan Stats & Facts

9. Australians finance roughly 90% of all new car purchases with a loan.

(Positive Lending Solutions)

While this doesn’t consider all car purchases, it does account for all new car purchases. Since most people don’t have a ton of cash lying around, it makes perfect sense that almost everyone takes out some sort of financing when purchasing a new vehicle.

10. Roughly 7.5% of Australians have a car loan.

(The New Daily)

This is a more surprising statistic in that only 7.5% of Australians currently have a car loan. That means most Australians either own their vehicle outright or don’t have a vehicle.

11. 14% to 17% of No Interest Loan Scheme (NILS) loans go to car maintenance.

(ABC News)

The No Interest Loan Scheme (NILS) is a loan scheme specifically for lower-income individuals in Australia. And since getting a new vehicle can be expensive, and the price of new cars is surging, it’s not all that surprising that a high number of these loans go to helping keep older vehicles on the road.

12. Used vehicle prices in Australia have risen 35% in the last year.

(ABC News)

While this isn’t exactly a car loan statistic, it does go to show why so many people are getting car loans in the first place. A surge of 35% in the used car market means if you’re looking for a more affordable vehicle option, there are simply not as many of them out there.

13. In June 2021 Australians purchased 110,664 new vehicles.

(Mozo)

While this doesn’t look at car loans, since we know that roughly 90% of all new vehicle purchases use a car loan as their financing option, that means there were roughly 99,500 new car loans in June of 2021 alone.

Frequently Asked Questions

There’s a ton of information out there about car loans, and it’s only normal to have a few questions. That’s why we answered some of the most frequently asked questions for you here:

Does Interest Rate Matter?

When you’re shopping for a car loan, the interest rate matters a lot. For a 60-month car loan for $40,000 with a 3.5% interest rate, you’ll pay $3,660 in interest over the life of the loan. But for that same loan with a 6.5% interest rate, you’ll pay $6,958, and with a 9.5% interest rate, you’ll pay $10,404!

Should You Trade an Old Vehicle In?

It depends on how much time you have. Typically, you can get more for your vehicle if you sell it to an individual, but trading it in at a dealership allows you to put the money into your new vehicle with no waiting period.

Should You Purchase a New or Used Vehicle?

This depends on your finances and what you want to drive. Used vehicles cost significantly less than new ones, but you also don’t know their service history. While new vehicles cost a little more, you get exactly what you want.

Do You Need a Down Payment for a Vehicle?

Most of the time you do not need a down payment for a vehicle. However, a down payment will help you lower your monthly payment, and it can improve the interest rate on your loan.

What Is the Best Length for a Car Loan?

This depends on your finances. Shorter car loans typically have you pay less in interest, but it presents a higher monthly payment. Ideally, you want a shorter car loan because it allows you to pay off your vehicle faster and helps prevent you from owing more on your vehicle than it’s worth.

Conclusion

Now that you know a little more about car loan stats and facts in Australia you can make an informed decision about any potential loans you’re considering. Whether you’re purchasing a new car or a new-to-you car, financing and car loans might be just what you need to open up a whole new world of possibilities.

Featured Image Credit: BELL KA PANG, Shutterstock

Contents