10 Consumer Spending Statistics and Facts: 2025 Update

-

Kristin Hitchcock

- Last updated:

Consumer spending is the driving force behind the economy. If consumers are not spending money, then businesses can’t stay open. Therefore, consumer spending can also be looked at to see how well the economy might be doing. While it isn’t the only factor to consider, it is very good for the economy to be doing well if consumer spending is down.

There are tons of factors that affect consumer spending. In many cases, it is practically impossible to tell why consumer spending may be up or down. There are just too many factors involved.

Therefore, predicting consumer spending can be challenging. It is typically best to look at consumer spending now and the direction it is moving in. Looking at external factors and making a prediction based on that is not always accurate.

Below, we’ve listed some of the most important consumer statistics that should give you a good look at the direction we’re headed in.

Click below to jump ahead:

The 10 Consumer Spending Statistics

- The average US household makes $61,372 a year after taxes.

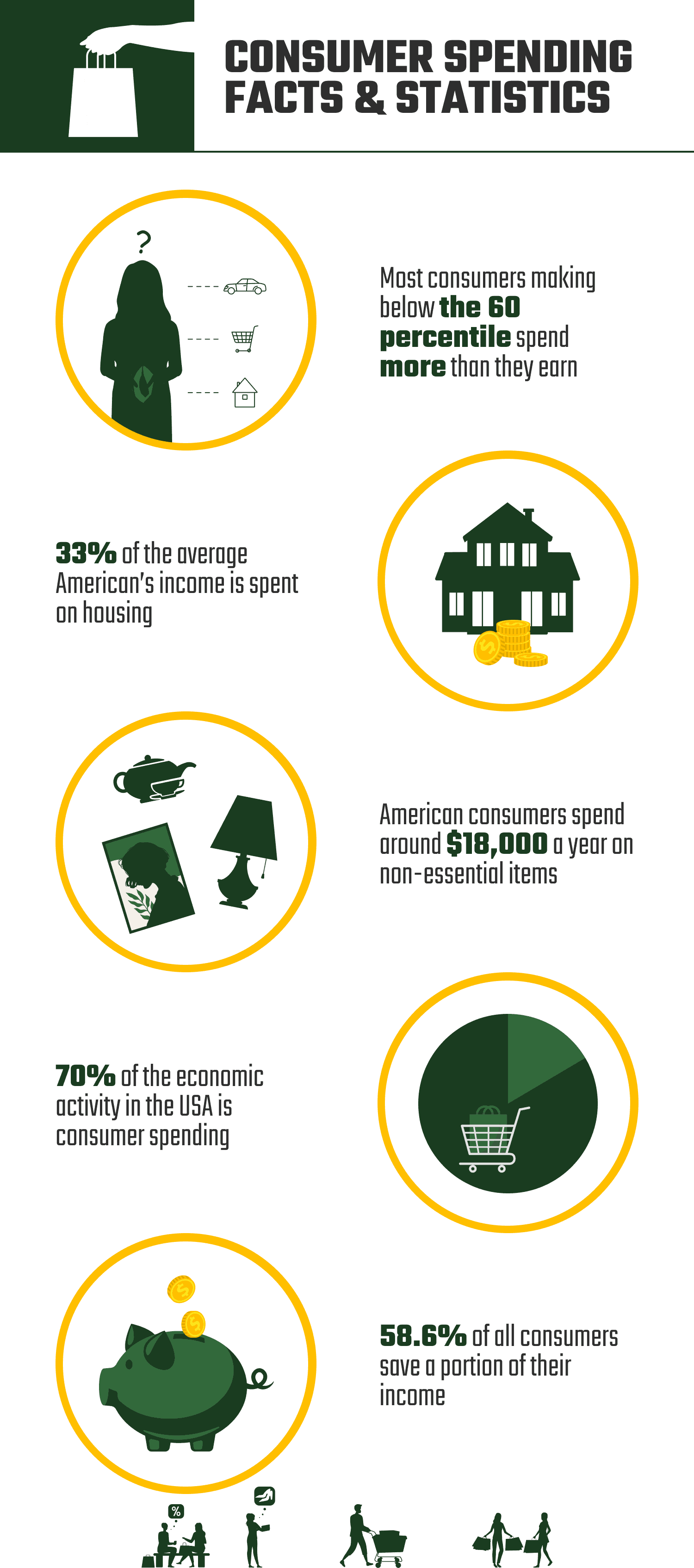

- Most consumers making below the 60-percentile spend more than they earn.

- In the US, consumer spending rose 2.5% in 2018.

- In total, USA consumers spent $23.28 billion on home entertainment in 2018.

- 33% of the average American’s income is spent on housing.

- $18,000 a year is spent on non-essential items.

- Healthcare costs have gone up 67% since 2006 and are projected to continue rising.

- 70% of the economic activity in the USA is consumer spending.

- 58.6% of all consumers save a portion of their income.

- Consumer spending has indicated that inflation has risen to over 6% since 2021.

How Much Do Consumers Spend?

1. The average US household makes $61,372 a year after taxes.

(Census)

The latest information about US household income has it at around $61,372, though there are large regional variations. This average income has increased by 1.8% each year or so. Generally, this income has been increasing, though there was a bit of a dip during COVID.

2. Most consumers making below the 60-percentile spend more than they earn.

(BLS Report)

Typically, overspending is a problem for many consumers in the USA and overspending appears to be worst for those over 65 and younger than 25. However, income is also lowest in these age brackets and the average consumer usually spends more than they earn.

3. In the US, consumer spending rose 2.5% in 2018.

(The Balance)

Consumer spending has been increasing over the years and will likely continue to do so. There are very few years where consumer spending goes down, usually due to serious problems in the economy. In 2018, consumer spending went up substantially.

What Are Consumers Buying?

4. In total, USA consumers spent $23.28 billion on home entertainment in 2018.

(Statista)

Home entertainment spending has been rising, especially since the pandemic. This category includes TVs, video games, and streaming services. With the rise of streaming services, more and more people are spending more money on their home entertainment needs.

5. 33% of the average American’s income is spent on housing.

(BLS)

This is more than the suggested 20%. Therefore, it appears that most consumers are spending more on housing than they necessarily “should” be. However, with rent prices rising in many areas, this may not be something that most consumers can get out of.

6. $18,000 a year is spent on non-essential items.

(SWANS Digital)

Much of this non-essential spending includes restaurants, takeout, impulse purchases, and purchasing lunch. However, whether or not you consider these purchases non-essential is a different story. (It is very easy to call takeout non-essential until you have to work late and don’t have time to make dinner.) Sure, some of these purchases are considered non-essential most of the time, but we found that many consumers disagreed that they were always non-essential.

7. Healthcare costs have gone up 67% since 2006 and are projected to continue rising.

(BLS Reports)

Healthcare costs are the biggest increase in most consumers’ budgets. While healthcare is currently not at the top of the list of expenses, it isn’t exactly very far away, either. Based on the current state of things, it is expected that healthcare costs will continue to rise, as well.

Consumer Spending and the Economy

8. 70% of the economic activity in the USA is consumer spending.

(Congressional Research Service)

The majority of economic activity in the United States is due to consumer spending. Without consumer spending, our economy cannot function. Companies need someone to purchase all of their stuff, or they cannot afford to pay their employees.

9. 58.6% of all consumers save a portion of their income.

(Congressional Research Service)

Of course, this income is not recycled back into the economy. Instead, it is saved. However, the higher the consumer’s income, the bigger percentage of their income that they saved. Of course, this is because those with more income had their essential items taken care of with a smaller portion of income and they could afford to save more money.

10. Consumer spending has indicated that inflation has risen to over 6% since 2021.

(BEA)

Consumer spending is utilized to track inflation. The price consumers pay for a variety of different services is used to determine the rate of inflation, since consumer spending is a large part of the economy.

Frequently Asked Questions About Consumer Spending

What is the average consumer spending?

(BLS)

The average consumer is spending about $61,334. This has actually gone down over the last few years. However, the price of living has gone up, which means that consumers likely are purchasing fewer things for more money. With that said, it may also be due to the pandemic, which is now turning around, so consumer spending may increase over the next few years.

What percentage is consumer spending?

The average consumer spending went up about 2.5% in 2021, which was slightly below estimates. Some quarters see very large jumps in spending, while others see decreased amounts. For instance, in July of 2020, spending went down by nearly 33%, likely because of COVID.

However, spending jumped up 41% in Jan 2021. Therefore, the economy actually made a pretty quick recovery after COVID.

What do consumers spend most of their money on?

Most consumers spend the majority of their money on necessary services, such as housing. Financial services are also included in this category, such as banking and financing. Health care, internet, and cable also fall into this category and take up most of the average consumer’s paycheck.

What determines consumer spending?

There are five primary things that determine consumer spending:

- Income inequality. Consumer spending goes up most when income gains are given to low-income families. These families are likely to spend all of their money on necessities until they reach a living wage. By comparison, income increases by higher-income earners are more likely to be saved or invested, which doesn’t benefit the economy as much.

- Disposable income. The more money a household has that they don’t need, the more they tend to spend. After all their necessities are met, many people begin to save money. However, they will also begin spending more on wants and impulse buys.

- Overall income. Of course, how much money the average consumer makes factors into how much money they spend. The higher the average income, the more likely people are to spend money. However, there are other factors to consider, like those we have discussed above.

- Household debt. Those with large amounts of debt are more likely to pay off their debt than spend more money. Consumer spending increases when debt is low, as there is typically more disposable income.

- Consumer expectations. Those who are confident about the future tend to spend more money than those who are not. Furthermore, if consumers believe that inflation is high, they may stop spending and put off important purchases until later.

How much of the GDP is consumer spending?

There are four components that make up the GDP. However, much of this is consumer spending. In fact, 70% of the GDP is made up of consumer spending. The other percentages include business investment, government spending, and exports of goods.

However, by far, consumer spending is the biggest.

What are the categories of consumer spending?

There are three main categories of consumer spending:

- Durable goods. These goods include items that have an average lifespan of three years or more. You don’t buy them all the often, in other words. It includes things like homes, vehicles, and furniture.

- Non-durable goods. These items need to be purchased regularly, such as fuel or food. Usually, these items are used up and consumable. However, others simply have a shorter average lifespan, like clothing.

- Services. Include everything that isn’t a consumable good. Banking, health care, housing, and other commodities fall into this category. This section alone makes up 40% of the GDP.

Conclusion

Consumer spending is a big portion of the economy. When consumer spending goes down, deflation occurs. Companies will try to off-load their goods by lowering prices. If this continues, the economy may restrict. Companies will stop making as many goods, close stores, or even go out of business. In the end, this leads to consumers losing their jobs, which makes consumer spending go down even more.

Consumer spending is extremely important for the economy. You can tell a lot about how the economy is doing by how much money people are spending.

However, it isn’t the whole story as other factors play a role, too. Plus, consumer spending is quite unpredictable. It can be challenging to determine when consumer spending may go up or down.

- (Census)

- (BLS Report)

- (The Balance)

- (Statista)

- (BLS)

- (SWANS Digital)

- (BLS Reports)

- (Congressional Research Service)

- (BEA)

- https://www.thebalance.com/components-of-gdp-explanation-formula-and-chart-3306015

- https://www.thebalance.com/consumer-spending-definition-and-determinants-3305917

- https://tradingeconomics.com/united-states/real-consumer-spending

Featured Image Credit: SeventyFour, Shutterstock

Contents