11 Single Family Rental Statistics in Canada: 2025 Update

-

Chantelle Fowler

- Last updated:

Note: This article’s statistics come from third-party sources and do not represent the opinions of this website.

Ask any Canadian, and they will have a story to tell you about the state of the single-family rental situation in the country. Canada is amidst a housing crisis that doesn’t seem to have an end in sight. This crisis is affecting not only prospective homeowners but also the vast population of the country’s citizens that choose to rent.

Click below to jump ahead:

The 11 Single Family Rental Statistics in Canada

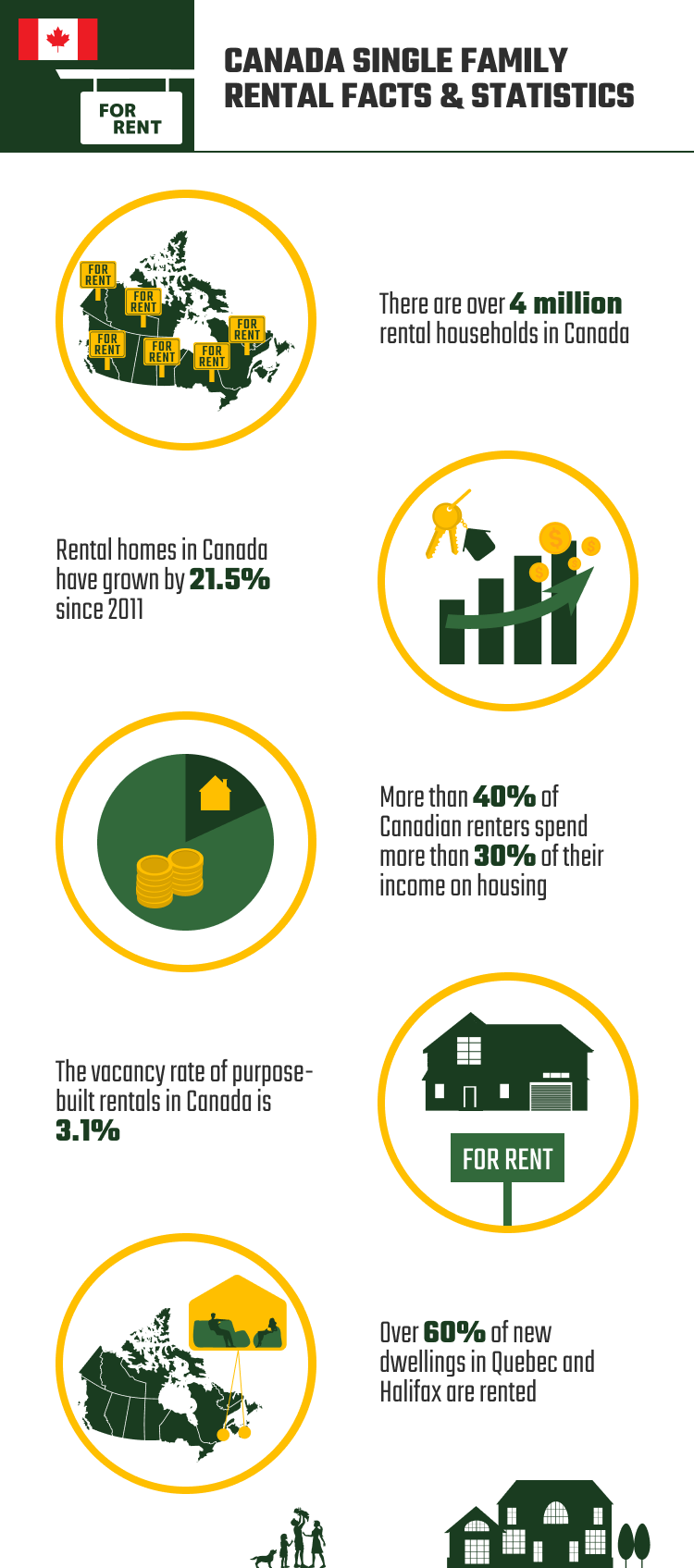

- There are 4,441,020 renter households in Canada.

- 66.5% of Canadians owned a home in 2021.

- Rental households have grown by 21.5% since 2011.

- Over 60% of new dwellings in Quebec and Halifax are rented.

- The vacancy rate of purpose-built rentals in Canada is 3.1%.

- More than 40% of Canadian renters spend more than 30% of their income on housing.

- The average price of a one-bedroom unit is $2,500 in Vancouver, B.C.

- The average price of a one-bedroom unit is $890 in St. John’s, Newfoundland.

- 29% of Ontario renters aged 15 to 29 spend over 50% of their income on rent and utilities.

- 45% of renters in downtown Halifax spend over 30% of their income on shelter.

- 8.4% of households living on reserve spend 30% or more of their income on shelter.

Rentals by the Numbers

1. There are 4,441,020 renter households in Canada.

(Rental Housing Index)

There are currently 4,441,020 rental households in Canada. Ontario has the biggest population of renters, with 1,552,300 of its residents currently residing in rental dwellings. Quebec came in a close second with 1,356,405. Northwest Territories has the smallest proportion of renters, with just 6,895 people residing in rental units.

2. 66.5% of Canadians owned a home in 2021.

(Statistics Canada)

A study done in 2021 showed that just 66.5% of Canadian households own their home, a stark decrease when compared to the numbers from 2011. In 2011, homeownership rates peaked at 69.0%. This decline in homeownership rates over the last decade was largest for young millennials between the ages of 25 and 29. In 2011, 44.1% of Canadians in this age group owned their home, while just 36.5% do now.

3. Rental households have grown by 21.5% since 2011.

(Statistics Canada)

According to the 2021 census, Canada saw a 21.5% increase in renter households over the past decade compared to just 8.4% in owner households. When the homeownership rate goes down as it has since 2011, it only makes sense that the rental rate would go up. Comparing these recent statistics to those from 1996 to 2006, we see that owner households increased by 23.7% during that decade while renter households had decreased by 0.7%.

4. Over 60% of new dwellings in Quebec and Halifax are rented.

(Statistics Canada)

Over 60% of new dwellings built in Quebec and Halifax between 2016 and 2021 are tenant-occupied. In Quebec, 61.3% of occupied dwellings built in this five-year frame are rented, compared to 60.7% in Halifax. Looking at the Western part of the country, 40.3% of all new dwellings are tent-occupied, compared to just 29.7% in Alberta.

5. The vacancy rate of purpose-built rentals in Canada was 3.1% in 2022.

(Rental Market Report)

The average national vacancy rate for purpose-built rental apartments in Canada was 3.1% in 2022, relatively consistent with the previous year. In 2020, rental vacancy rates throughout the country increased sharply, effectively reversing a several-year-long trend of declining rates that began in 2017. As a result of the COVID-19 pandemic, the demand for short-term rentals decreased and began converting them into long-term apartment rentals. This resulted in the supply growth far outpacing demand by around 26,000 units.

Rental Income & Cost Statistics

6. More than 40% of Canadian renters spend more than 30% of their income on housing.

(Rental Housing Index)

Over 40% of the 4,441,020 renter households in Canada spend over 30% of their income on housing. The Canada Mortgage and Housing Corporation says housing is affordable if 30% or less of an individual’s income goes toward rent.

This statistic can be more staggering if one looks closer at major city centers. For example, 46% of North Vancouver renters spend over 30% of their income on rent and utilities, while 24% spend over 50%. In Toronto Center, 47% of renters spend 30% of their income on rent, while 25% spend over 50%.

7. The average price of a one-bedroom unit is $2,500 per month in Vancouver, B.C.

(Zumper)

Vancouver remains the priciest market for renters in all of Canada. A one-bedroom unit is $2,500 on average in the largest city in B.C., a 19% increase from last year’s price. Conversely, a two-bedroom unit in Vancouver is around $3,500, a 3.6% drop over the previous year. For comparison’s sake, a one-bedroom in Toronto is $2,130, an 18.3% increase from last year, while two bedrooms in Toronto go for $2,680, a 19.1% increase over the previous year.

8. The average price of a one-bedroom unit is $890 in St. John’s, Newfoundland.

(Zumper)

One of the most affordable large cities for renters is St. John’s, Newfoundland. The average rent for a one-bedroom unit in St. John’s is $890, while their two bedrooms are $1,000. Though their rental prices are increasing, they’re rising much slower than in other areas of the country. The cost of one-bedroom units has risen 4.7% over the last year, while two-bedroom units have seen just a 1% increase.

9. 29% of Ontario renters aged 15 to 29 spend over 50% of their income on rent and utilities.

(Rental Housing Index)

There are 285,375 rental households in Ontario occupied by people in the 15 to 29 age range. Of renters in this age bracket, 29% spend 50% or more of their income on rent and utilities. In addition, 10% are living in overcrowded conditions.

10. 50.4% of renters in downtown Kingston, Ontario, spend over 30% of their income on shelter.

(Statistics Canada)

Unaffordable housing rates are the highest downtown for both renters and owners in Canada. For example, 50.1% of renters in downtown Kingston spend more than 30% of their income on shelter costs. This isn’t just an Ontario problem. 47.7% of downtown Halifax renters and 44.8% of downtown Vancouver rental households spend more than 30% of their pay on rent.

11. 8.4% of households living on reserve spend 30% or more of their income on shelter.

(Statistics Canada)

Less than one-tenth of the households (including owners, renters, and those who had dwellings provided to them) on reserves spend 30% or more of their income on shelter, compared to 20.9% of off-reserve Canadian households. Conversely, 5.9% of reserve households living in dwellings provided by their First Nation or Indian band or the local government spent more than 30% of their income on shelter costs. Though 91.6% of all households on reserves spend less than 30% of their income on shelter, 24.7% of the renters living on reserves spend more than that 30% threshold.

Frequently Asked Questions About Single Family Rental Statistics in Canada

Is Canada in a housing crisis?

Yes, Canada is in the midst of a housing crisis. Prospective homeowners can’t find housing; the homes they do find are costly, and first-time homebuyers can’t get into the market. Between 2003 and 2018, home and property prices in some Canadian cities raised to 337% (Forbes). As a result, renters are facing high rents and housing insecurity.

How do vacancy rates affect rental options?

Cities with high vacancy rates have greater house supplies – good news for prospective renters and bad news for landlords. However, vacancy rates can vary significantly depending on the city and even within different areas within the city. Vacancy rates can also vary greatly depending on the province. For example, in Vancouver, the vacancy rate is just 1.2%, while in Edmonton, it is 7.3% (Canadian Mortgage and Housing Corporation).

What is the government doing to help the housing crisis?

Provincial and federal governments have tried several initiatives in response to the housing crisis.

The British Columbia government tried to slow the real estate market’s growth by implementing a foreign buyer tax in 2016. The tax was expected to add a significant cost to foreign buyers while increasing the provinces’ tax revenue.

In 2017, Ontario introduced its Fair Housing Plan measures to help residents find affordable homes and protect renters through stricter rent controls.

The Canadian government announced the Prohibition on the Purchase of Residential Property by Non-Canadians Act to come into effect on January 1, 2023. This legislation will ban non-Canadians from purchasing residential property and comes as a direct response to Canadians’ concerns regarding housing inflation.

Is it better to rent or buy in Canada right now?

Both renting and buying have pros and cons. Renting provides flexibility and is less hassle and maintenance, while buying provides stability and capital gains and allows you to build up equity. The downsides of renting are that it is less stable and there is no chance to build equity, while homeowners have to look at the ongoing maintenance costs and potentially slow return on investment.

The decision to continue renting or buying is a big one and not something that should be taken lightly. First, you’ll need to consider your current financial situation and employment status. A good rule of thumb is if your housing costs (including interest, tax, heat, mortgage) and other debts (car loans, credit cards) make up less than 40% of your gross income, you may be in an excellent position to consider investing in a home.

Conclusion

The rental market in Canada is unpredictable and unstable right now. It’s not a secret that many Canadians are grappling with the reality of its inflexibility and unreliability. Many families are facing exorbitantly high rent rates and struggling to make ends meet, while others who may be in a position to buy a home soon cannot find one within budget in their desired location.

- Rental Housing Index Family Renter Households

- Statistics Canada Housing Market

- Statistics Canada New Construction

- Rental Market Report

- Rental Housing Index Family Renter Households

- Zumper

- Rental Housing Index Age Profile

- Statistics Canada Housing Market

- Statistics Canada Reserve Households

- Canadian Mortgage and Housing Corporation

- Forbes

Featured Image Credit: Dragana Gordic, Shutterstock

Contents