7 Single Family Rental Statistics in Australia: Updated In 2025

-

- Last updated:

The real estate rental business in Australia has always been as dynamic as it is everywhere else in the world. What’s more, it often mirrors subtle shifts in micro and macroeconomic forces, hence the reason why stakeholders in the industry are now using it as a metric to predict future patterns or trends.

The prime goal of today’s post is to shine a spotlight on the single-family rental data collected by various research institutions. We’re confident that these statistics and facts will provide you with some sort of insight into what’s going on in the Australian property market.

The 7 Single-Family Rental Statistics & Facts

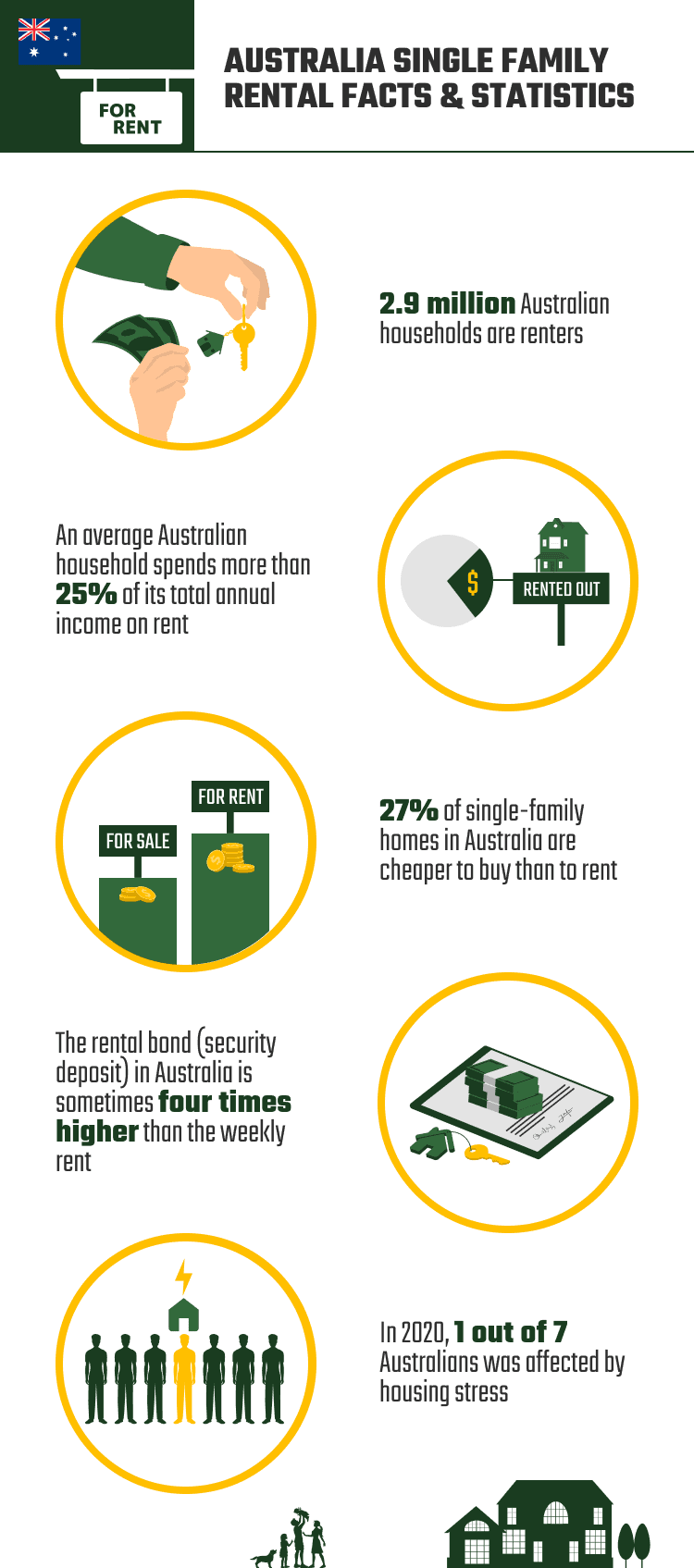

- 2.9 million Australian households are renters.

- In 2020, 1 out of 7 Australians was affected by housing stress.

- Less than 3% of Canberra’s single-family rental properties are advertised monthly.

- 71% of Australians pay unaffordable rent.

- An average Australian household spends more than 25% of its total annual income on rent.

- The rental bond in Australia is sometimes four times the weekly rent

- 27% of single-family homes in Australia are cheaper to buy than to rent.

General Single-Family Rental Statistics

1. 9 Million Australian Households are Renters.

(Australian Institute of Health Welfare)

The Australian government has always reiterated that secure and affordable housing is basic to the overall well-being of any citizen. That’s why they are working around the clock, formulating policies that would make it easier for an average Joe to own or rent a home.

It’s no secret that property ownership is a widely held aspiration, seeing as it provides housing security, in addition to long-term economic benefits. Sadly though, in the current economic conditions, not everyone can attain that goal.

In the recently concluded census, we discovered that 31% of the total households in Australia were renters. And that percentage represented 2.9 million households. 2.4 million of the 2.9 were rented from private landlords. The housing authority provided shelter to 277,500 households, while the remaining 223,600 rented from other landlords.

2. In 2020, 1 Out of 7 Australians was Affected by Housing Stress.

(ABC)

Simply put, housing stress is a situation that exists when the average rental costs are relatively higher than the average household income. Some experts prefer defining it as the insufficiency of adequate housing as a result of expanding population size.

In a survey carried out by The Australian National University, it was estimated that the number of people who struggled to cover their rent was higher during the onset of the pandemic than it was 3 months prior. They also found out that there was a clear relationship between the age of an individual, and his/her inability to pay rent.

Apparently, young people (those between the ages of 18 to 24) were more affected by the pandemic than the older generation and thus caught up in housing stress.

3. Less Than 3% of Canberra’s Vacant Rental Properties are Advertised Monthly

(MPA)

In a healthy real estate market, the percentage of vacant rental properties advertised monthly is supposed to be higher than 3%. This low vacancy rate doesn’t necessarily mean that single-family renters are happy living in Canberra.

SQM Research conducted a survey that found out that the high rental rates have made potential renters scared of relocating to new homes. That’s why very few properties are currently available for listing. And if nobody’s listing, there’s nothing to advertise.

Rental Costs Statistics

4. 71% Of Australians Pay an Unaffordable Rent

(AHURI)

From the data collected, it’s safe to say Australia has been grappling with a housing crisis for quite a while now. The rental vacancy rates are at an all-time low, and the rent prices keep rising at an exponential rate. As of September this year, the national rental vacancy rate stood at 0.9%. The last time we experienced something similar was in 2006 when the rate was 0.8%.

This crisis has forced our citizens to pay more than they usually do, even if it means spending more than 30% of their monthly income on rental expenses.

5. An Average Australian Household Spends More Than 25% of Its Total Annual Income on Rent

(Loans.com.au)

25% sounds like a reasonable amount until you start replacing the percentages with actual figures. It means that households are now paying a weekly median rent of $411, which translates to $1,784 per month.

The cheapest city to rent a single-family unit is Perth, while Canberra and Sydney tied at the top as the most expensive cities. But that’s to be expected since Canberra is the capital city of Australia and Sydney is popular globally.

To mitigate the cost of renting, Australians are now employing different tactics. Some are downsizing to smaller or less flashy apartments, while others are looking for housemates. It goes without saying that splitting the rent is way cheaper than catering to it as a single individual.

We’ve also seen more and more people move houses in the middle of the year when the demand for single-family homes is lower than usual.

6. The Rental Bond in Australia Is Sometimes Four Times the Weekly Rent

(NT.GOV.AU)

The security deposit is what’s commonly known as the bond, in Australia. And it’s the payment made to a landlord to protect them against any financial risks, should the tenant fail to meet their contractual obligations.

Property owners are now taking advantage of the dire housing situation in the country to mint more money from prospective tenants. Instead of asking for a security deposit that’s equal to the weekly rent, they are now asking for an amount that’s as high as the monthly rent.

For example, if your rental is $400 per week, you’ll be compelled to pay $1600 as the security deposit, before taking control of the property. That’s one of the reasons why households are now choosing to commit to a longer lease. Very few people are looking to move because they’re afraid of dealing with the costs that they might incur during the process.

7. 27% of Single-Family Homes in Australia are Cheaper To Buy Than to Rent

(Savings.com.au)

Proptrack—an organization that has taken it upon itself to offer solutions to some of the issues plaguing the property market in Australia—recently released a report that gave a comprehensive financial analysis of the costs involved in buying and renting single-family dwellings in various cities.

According to that report, you’re better off buying a single-family home than renting one, as the costs involved are significantly lower in the long run.

A different report released by The Australian Financial Review also gave convincing reasons why Australians should consider buying instead of renting. The detailed report concluded that the cost of repaying one’s mortgage was way lower than what they would typically pay as rent, in more than 500 suburbs.

Frequently Asked Questions (FAQs)

What Kind of Housing Costs or Expenses Fall Under the Property Owner’s Jurisdiction?

In Australia, the owner of the property is responsible for the taxes and the unit service charges. The tenants, on the other hand, are expected to ensure all their utility bills are paid in due time unless otherwise stated in their contracts.

The general maintenance expenses will also be under the tenant’s purview, but the owner will be tasked with ensuring that the provision of certain essential services—for example, water and sewage—isn’t impeded in any way.

If for one reason or another, the property owner cannot get repairs done in a timely fashion, the tenant can work on them, and then forward the bill to the landlord’s address. Deducting the expenses incurred from the rent is not acceptable.

Why are Rental Rates High in Australian Cities?

The rental rates are always influenced by the location of a property, just like the prices. Australian cities are considered fast-growing areas—with endless opportunities—and that’s why so many people are relocating from rural regions. This is the other reason why cities such as Canberra have low vacancy rates.

In economics 101, we learned that when the demand for a product exceeds its supply, the prices slowly start to rise. That’s what’s happening in Australian cities. The demand for rental units is drastically surpassing their supply.

Is Sydney an Expensive City for a Single-Family Renter?

For the longest time, Canberra was considered the most expensive city in terms of housing, among other aspects. But a shift in the economic conditions has pushed Sydney up, leveling it with Canberra.

In the last few months, Canberra has seen its asking rent fall by 0.4%, while that of Sydney keeps on rising. Property investment experts are of the opinion that this rise is being caused by the increased number of migrants streaming into the harborside city.

Final Word

It wouldn’t be fair for us or for anyone to put the blame on landlords for the increased rental rates around the country. They are just trying to protect their investments, the same way we would have, had we been in the same position.

Blaming the government is also pointless because it can only do so much to shield us from various external economic variables. The best that they can do is to formulate policies that alleviate the situation, and hope things get better.

We are certain that these stats will give you a solid overview of what’s happening in the Australian real estate market.

Related Reads:

Featured Image Credit By: Collov Home Design, Unsplash

Contents