11 Student Loan Debt Statistics & Facts: 2025 Update

-

Pete Ortiz

- Last updated:

With student loans being pushed back again, this time to August 31, millions of Americans can breathe yet another sigh of relief.

Two years have passed since the government paused federal loan repayments to help borrowers handle the economic strains stemming from COVID. Unfortunately, temporary relief doesn’t spell the end of a worsening crisis. Amid the pandemic, loan forgiveness talk is gaining steam in some circles as debt continues growing. With the payment restart on the horizon, student debt could be worse than pre-pandemic levels.

So, what is the state of student loan debt today, and what can borrowers do to ease the burden? In this article, we’ll look at 11 student loan debt stats and facts to help make sense of a troubling situation.

Click below to jump ahead:

Top 11 Student Loan Debt Statistics and Facts

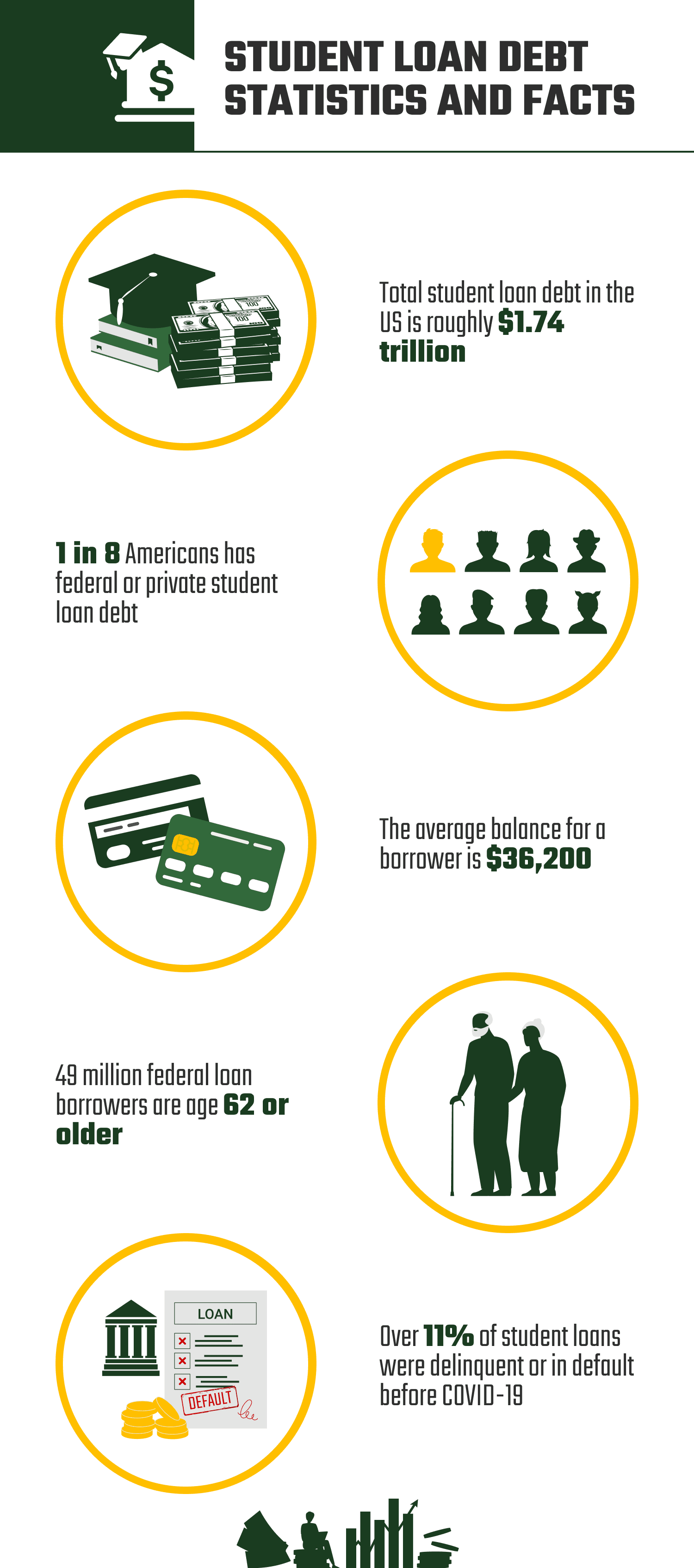

- Total student loan debt in the U.S. is roughly $1.74 trillion.

- 1 in 8 Americans has federal or private student loan debt.

- The average balance for a borrower is $36,200.

- 49 million federal loan borrowers are age 62 or older.

- An estimated $195 billion worth of payments was waived through April 2022.

- 83% of people with increasing balances made no progress on paying back their federal loans during forbearance.

- 72% of federal loan borrowers are not ready to resume payments after the moratorium ends.

- 11% of student loans were delinquent or in default before COVID.

- By 2021, only 32 people had debt canceled through IDR plans.

- 7% of eligible borrowers apply for loan forgiveness.

- Only 56.9% of 2021 high school graduates completed the FAFSA.

Student Debt Overview

1. Total student loan debt in the U.S. is roughly $1.74 trillion.

(St. Louis Federal Reserve)

In the United States, the total amount owed on all student loans, both federal and private, was $1.747 trillion in Q4 2021. That number is a rare decrease from the previous quarter when the total reached a record $1.75 trillion. It is only the second quarterly decrease since 2006, the first coming in Q4 2020.

Most student debt belongs to federal loans. There is over $1.6 trillion spread across direct subsidized and unsubsidized, Perkins, PLUS, and consolidation loans. Meanwhile, private student loan debt is just over $140 billion.

2. 1 in 8 Americans has student loan debt.

(FRBNY Consumer Credit Panel/Equifax)

43.48 million people share the $1.74 trillion in student debt. That’s an increase from 2021, when there were 43.16 million borrowers nationwide, the first uptick since 2018.

Despite the slight lull over the past 3 years, the number of borrowers has been on a general upward trend for years. Over the past two decades, student loan debtors have doubled. In 2012, there were roughly 38.8 million student loan borrowers and just 23.3 million in 2005.

3. The average balance for a borrower is $36,200.

(FRBNY Consumer Credit Panel/Equifax)

The national student debt is climbing faster than the number of people in debt. From 2005 to 2021, the number of people with a student loan balance increased by 86%. Meanwhile, the student debt went up by over 380%!

With that growth disparity, it’s clear that individuals owe more than they did in 2005. According to the Federal Reserve Bank of New York, the average balance, including federal and private loans, was $36,200. That’s an increase of around 130% from the $15,651 average in 2005. And with inflation growing only 47% since then, there’s more driving the surge than just the changing value of the dollar.

4. 49 million federal loan borrowers are age 62 or older.

(Federal Student Aid)

It would make sense that the 24 and under crowd would owe the most in student loans, but every age group is full of people currently in debt. Roughly 8.9 million individuals with open balances are 50 or older, and 2.49 million are over 62. Those numbers continue to rise as the student debt among individuals aged 60 and over increases by 50% every 5 years.

Student Debt and COVID-19

5. An estimated $195 billion worth of payments was waived through April 2022.

(FRBNY Consumer Credit Panel / Equifax)

In response to the financial stress of the pandemic, the Trump administration put a halt to most federal student loan repayments. Thanks to the stoppage, 37 million people had some or all of their direct loans put into administrative forbearance. In total, that lowered the immediate debt by almost $200 billion.

Payments are due to resume after the new August 31 deadline. After six deadline changes already, there’s always the chance that the start date could get pushed back yet again. Until then, the affected loans are not earning interest, and borrowers have the option to take advantage of the 0% rates to lower their principal.

6. 83% of people with increasing balances made no progress on paying back their federal loans during forbearance.

(Liberty Street Economics)

The government-imposed forbearance did great things for millions of people, particularly direct loan borrowers who were delinquent on payments. The moratorium saved borrowers almost $7,000 on average over its 25 months, and those savings will likely increase with the extended deadline. And, with the option to pay at 0% interest until then, there were tons of ways to catch up and get ahead with repayments.

Unfortunately, most affected borrowers didn’t take advantage of the lower interest rate. Of individuals who had increasing balances before the freeze, such as people in income-driven repayment (IDR) plans, 83% had not lowered the amount they owed. Among those with decreasing balances on direct loans, 66% had not reduced theirs during the stoppage.

7. 72% of federal loan borrowers are not ready to resume payments after the moratorium ends.

(PR Newswire)

The substantial individual savings from forbearance may not have been spent on student loans, but it didn’t all go to waste. Although 52% of people used the savings to pay for everyday necessities, 30% paid off other debts, and 28% used it to get back on their feet. But the picture is still bleak for almost 3/4ths of federal loan borrowers as the moratorium deadline draws near.

Most federal loan borrowers are not prepared to restart payments, with 72% saying they aren’t financially stable enough. Among individuals whose income was affected by the pandemic, 86% say they cannot afford to resume payments.

Student Debt Management

8. 11% of student loans were delinquent or in default before COVID.

(Student Loan Hero)

Graduates weren’t having an easy time repaying student debt before the moratorium. Over 11% were at least 90 days delinquent or already in default before the reprieve. Incredibly, before the pandemic, 48% of people who went to for-profit colleges defaulted within 12 years after leaving.

9. By 2021, only 32 people had debt canceled through IDR plans.

National Consumer Law Center

One of the more scandalous revelations from last year involved the tremendous mismanagement of the IDR program since it began in the 1990s. These plans base monthly payments on income to ensure they stay affordable. Plus, after either 20 or 25 years, the government cancels the remaining debt. That was critical, as the low payments often didn’t even cover the interest, and many borrowers saw negative amortization as a result. By having an eventual cancellation, these loans would keep borrowers from becoming locked in an endless payment cycle.

Great in theory but poor in practice, the IDR failed many who should have benefited from debt cancellation. Due to mishandled loans, only 32 out of 4.4 million people with at least 20 years worth of payments had canceled debt. Through long-term forbearance and miscommunication, loan servicers set back millions of borrowers.

The good news is that the government is doing something about the mismanagement. In April, the Department of Education pledged to remedy the issue with moves that will, among other things, result in immediate debt cancellation for over 40,000 people and give 3.4 million borrowers three years’ worth of credit toward loan forgiveness.

10. 7% of eligible borrowers apply for loan forgiveness.

(Education Data)

Loan forgiveness is a hot topic of conversation these days, but the mechanisms are already in place for millions of borrowers to cancel their debt. There are 3 million student borrowers who can apply for student loan forgiveness. But thanks to miscommunication and confusion over eligibility, only 200,000 borrowers—about 6.7% of those eligible for forgiveness—have applied for it.

11. Only 56.9% of 2021 high school graduates completed the FAFSA.

(National College Attainment Network)

Federal loans provide some of the most substantial gateways to higher education. If you qualify, you often get better interest rates than private loans offer, and you get numerous perks to make repayment more manageable. Yet few college-bound students take full advantage of financial aid, as only 56.9% of 2021 high school graduates have completed the FAFSA.

Government aid goes woefully underused. According to Education Data, over $2 billion of federal aid is left on the table in an academic year. Much of that can be attributed to low financial aid applications.

How Can Refinancing Help With Student Loan Costs?

One possible solution for borrowers who have trouble with repayment is refinancing for better rates. Almost 3/4ths of those who refinanced say it helped make payments more manageable. With good credit, you could get a lower interest rate and save thousands of dollars over the life of the loan. You also lose government options like IDR and forbearance when you transfer to a private loan, so it’s crucial to weigh all the factors before deciding to refinance.

Why Is Student Loan Debt Growing?

According to the Bipartisan Policy Center, the primary causes of growing loan debt include a rapid rise in college costs alongside declining state support and the value of federal grants. Plus, increased access to federal loans incentivizes people to take on debt.

Between poorly-designed repayment schemes, unscrupulous lending practices, and increasing tuition costs, the setting is perfect for borrowing to get out of control. But the greater issue could be financial illiteracy.

According to the results of the Student Loan Financial Education Test, most college and college-bound students are ill-prepared to responsibly borrow money. 8,904 respondents took the National Financial Educators Council’s short questionnaire, and only 34% passed. That lack of readiness coupled with uncapped loans and low long-term monthly payments acting as another essential driver of increasing debt have resulted in an apparent willingness to borrow without considering or understanding the consequences.

Final Thoughts

Student loan debt is getting worse, and the pandemic leaves the immediate future unclear and troubling for most borrowers. Still, hope is on the horizon as the government commits to better oversight and immediate action for millions struggling under the crushing weight of debt. With more transparency and better education, prospective borrowers will be poised to make more financially sound decisions and take full advantage of the aid already in place.

Featured Image Credit: Rawpixel.com, Shutterstock

Contents