15 Consumer Debt Statistics & Facts: 2024 Update

-

- Last updated:

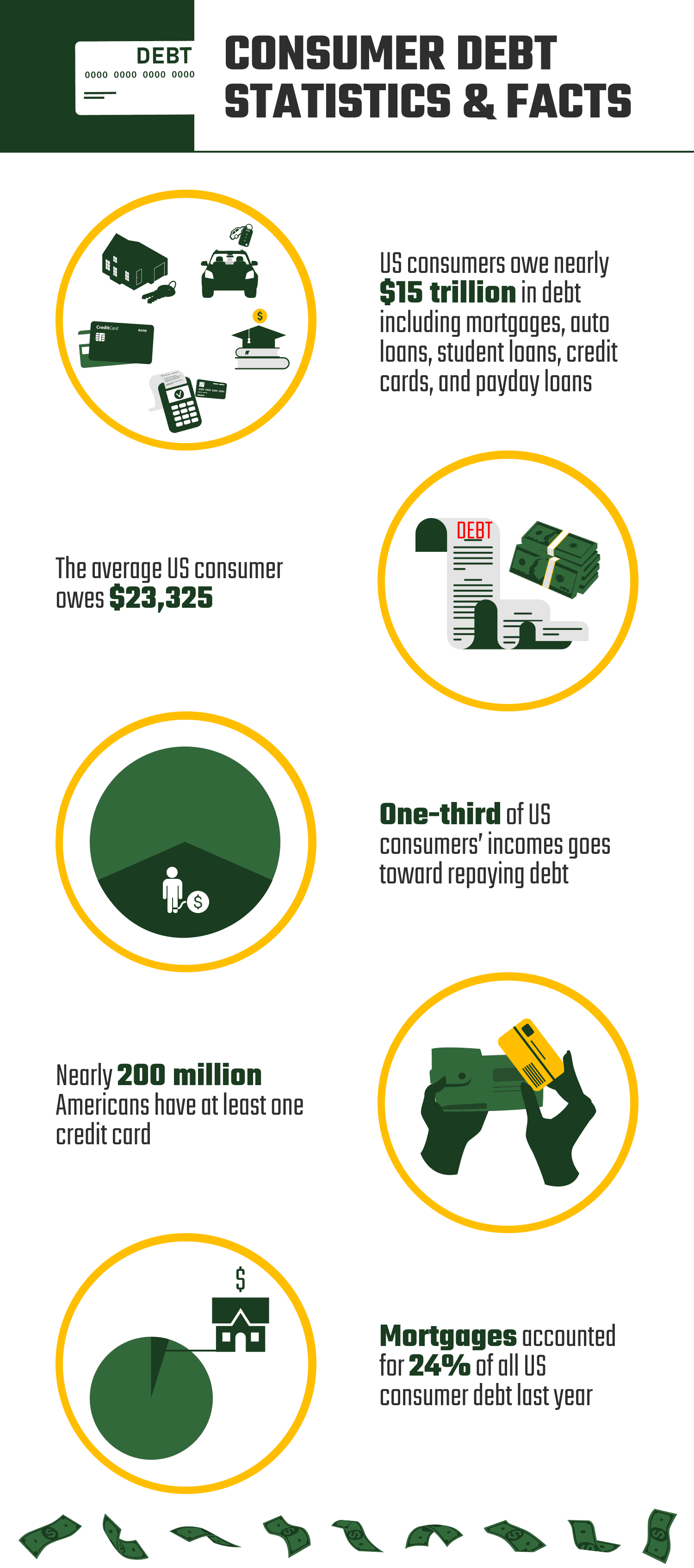

Consumer debt is the total amount of debt that is used to pay for goods. A home mortgage, although often considered good debt, is considered a form of consumer debt and accounts for approximately a quarter of all personal debt. Other forms of consumer debt include credit cards, student loans, car loans, and payday loans.

The total amount owed by US consumers increased during 2021, thanks in part to the Covid pandemic, and this followed a 6% rise in 2020. Although all generations have some debt, Gen X has the highest debt, with those entering midlife owing money on mortgages, auto loans, and some student debt.

Click below to jump ahead:

The Top 15 Consumer Debt Statistics

- US consumers owe nearly $15 trillion.

- Consumer debt rose 6% in 2020.

- Total revolving debt in the US is just over a trillion dollars.

- The average US consumer owes $23,325.

- Excluding mortgages, the total outstanding debt for US consumers is more than $4 trillion.

- One-third of consumers’ incomes go toward repaying debt.

- 20% of adults do not know exactly how much debt they have.

- The Gen X generation has the highest level of consumer debt.

- 53% of Americans consider mortgages to be good debt.

- Mortgages accounted for 24% of all consumer debt in 2021.

- Nearly 200 million Americans have at least one credit card.

- Consumers with credit cards hold an average of 2.7 cards each.

- The average US household owes $5,315 on credit cards.

- Credit card debt declined in 2020 for the first time in 8 years.

- $95.9 billion is owed in student loans.

Total Debt

1. US consumers owe nearly $15 trillion.

(Experian)

The Covid pandemic affected economies all around the world. It saw unemployment figures rise and caused anxiety among consumers who were unsure how or if the economy would recover. The pandemic led to extraordinary debt increases despite massive reductions in consumer spending. As a result of this, US consumers now owe $15 trillion in consumer debt.

Consumer debt is any money that is borrowed to pay for products that will be used by the individual consumer or their household. These debts include mortgages, auto loans, student loans, credit cards, and payday loans.

2. Consumer debt rose 6% in 2020.

(Experian)

Total debt in 2019 stood at $14.08 trillion, which means that American consumers owed more than $800 billion in 2020—an increase of 6%. This is the highest annual increase in more than 10 years. Total debt in 2010 was $11.32 trillion, which means that there has been an average annual increase in debt of 2%.

3. Total revolving debt in the US is just over a trillion dollars.

(Federal Reserve)

Revolving debt comes from credit accounts that have a maximum limit and that allow the borrower to borrow money repeatedly while paying off a portion or all of the debt each month. Credit cards are the most common example of this type of debt. Another form of revolving debt is the Home Equity Line of Credit (HELOC), which is secured against the value of a borrower’s property and is effectively a second mortgage. The total amount of revolving debt is now more than $1 trillion in the US.

4. The average US consumer owes $23,325.

(Statista 1)

Personal debt, or consumer debt, is debt that is used mostly for consumption and not for investment. The average American owes $23,325 when considering all forms of personal and consumer debt.

5. Excluding mortgages, the total outstanding debt for US consumers is more than $4 trillion.

(Federal Reserve)

Mortgages account for nearly a quarter of all debt, and many consumers and financial experts consider home mortgages as good debt. They have lower interest rates than other forms of credit because the money borrowed is secured against the value of the property purchased. When ignoring mortgage debt, the total money owed by US consumers is more than $4 trillion.

6. One-third of consumers’ incomes go towards repaying debt.

(NorthWesternMutual)

Monthly debt repayments can include mortgage repayments amounting to several hundred dollars, as well as auto loans, student loans, and credit cards. Individually, some of these repayments may not be too high, but when combined, they soon add up with the average consumer making repayments that are equivalent to one-third of their earnings.

7. 20% of adults do not know exactly how much debt they have.

(NorthWesternMutual)

With so many debt sources, it can be difficult to keep track of repayments. Missing a repayment typically attracts fines and penalties, which can lead to even more debt. One in five adults state that they are not exactly sure how much money they owe.

8. The Gen X generation has the highest level of consumer debt.

(NorthWesternMutual)

The Gen X generation has the highest levels of debt, but this is perhaps unsurprising because, by the age of 40, a person will usually have a mortgage, credit cards, auto loans, and may still be repaying some student loans.

Gen Xers have an average debt of $36,000 per person. Baby boomers, who have typically repaid more of their mortgage and other loans, owe $28,600, while Millennials, some of whom have just entered the property market, owe $27,900. Gen Z, who have yet to take out mortgages but may owe some student loans, owe an average of $14,700.

Mortgages

9. 53% of Americans consider mortgages to be good debt.

(Statista 1)

Most people have to borrow money to finance the purchase of a house, and they do so by using a home mortgage. Mortgages are often described as being good because they are used to purchase an asset, and the interest rates offered are lower than with other forms of debt. However, borrowers can owe hundreds of thousands of dollars on their mortgage, and, especially when borrowed over a long term, can end up paying $100,000 or more in interest and fees.

Despite the decades-long financial commitment, more than half of Americans believe a mortgage to be a good type of debt.

10. Mortgages accounted for 24% of all consumer debt in 2021.

(Statista 3)

A mortgage is usually the largest single debt that a consumer has and can mean that a person owes hundreds of thousands of dollars. Nearly a quarter of all consumer debt in 2021 was mortgage debt.

Credit Card and Student Loan Debt

11. Nearly 200 million Americans have at least one credit card.

(Debt)

Many consumers have credit cards. They use them for daily purchases, large individual purchases, and to enjoy better interest rates and repayment terms when transferring a balance from one card to another. In total, 191 million Americans have at least one credit card.

12. Consumers with credit cards hold an average of 2.7 cards each.

(Debt)

When considering those 191 million credit card holders, the average number of cards held is 2.7 per person. Having more than one credit card can be beneficial to an individual’s credit score. It increases the total amount of available credit a person has, and it means that their credit utilization ratio (the amount of credit used as a percentage of the amount of credit available) is lower. However, having multiple cards requires careful management and spending in order to avoid taking on too much debt.

13. The average US household owes $5,315 on credit cards.

(Debt)

Credit card debt is the second largest form of consumer debt after mortgages, and it can greatly impact a household’s disposable income. The typical US household owes more than $5,300 in credit card debt.

14. Credit card debt declined in 2020 for the first time in 8 years.

(Experian)

In 2019, consumers owed nearly $830 billion on credit cards. In 2020, this figure dropped to $756 billion—a reduction of nearly 9%.

15. $95.9 billion is owed in student loans.

(Statista 1)

Student loans are a form of loan, usually subsidized by the federal government, that can be used to access higher education. Typically, a student has to start repaying these loans within 6–9 months of graduating. Interest rates are typically low with this kind of debt, but the average student leaves college owing more than $40,000, with nearly $100 billion owed in total over all student loans.

Frequently Asked Questions

What Is the Largest Consumer Debt?

Mortgages account for 24% of all consumer debt, making it the largest single form of debt. Credit cards are the next largest consumer debt. (Statista 3)

What Is Canada’s Consumer Debt?

Canada’s household debt was $2.1 trillion in January 2022. This was up from a reported $2.08 trillion in December 2020. (CEIC)

How Much Is UK Consumer Debt?

By the end of January 2022, UK consumer debt stood at £1,76 billion, which is roughly equivalent to $2.23 billion. This figure was up £62 billion from the same period in 2021 and meant that the average debt per household was $63,582, including mortgages and other forms of debt. (The Money Charity)

Conclusion

Consumer debt rose significantly through the Coronavirus pandemic, although credit card debt actually declined. In total, US consumers now owe nearly $15 trillion, with the average consumer owing just over $23,000, including mortgage debt. As a result of this, they have to pay approximately one-third of their monthly income on debt repayments and fees.

Feature Image Credit: Goumbik, Pixabay

Contents